India obtains new information about Swiss bank accounts in the yearly information exchange.

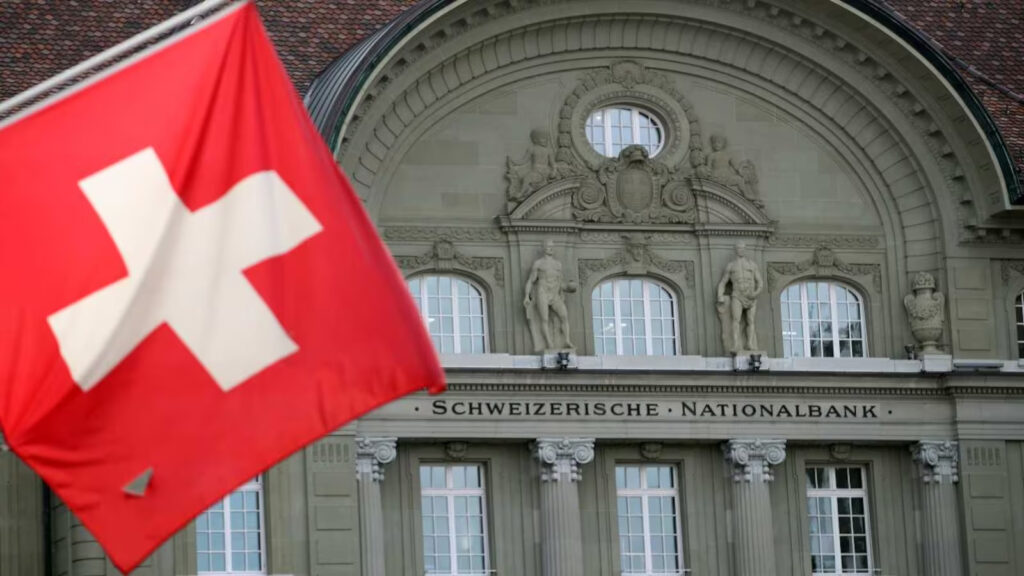

India has received its fifth set of Swiss bank account details through the automatic information exchange framework. Switzerland has shared information on nearly 3.6 million financial accounts with 104 countries, including India. This exchange of information includes details on hundreds of financial accounts, many of which are associated with individuals, corporations, and trusts. The shared information encompasses identification, account information, financial data, and more.

The exact amount involved in this exchange of information has not been disclosed due to confidentiality agreements. However, the data will be used for investigations into suspected tax evasion, money laundering, and terrorism financing. The exchange took place last month, and Switzerland is expected to share the next set of information with India in September 2024.

This exchange of information allows tax authorities to verify whether taxpayers have accurately declared their foreign financial accounts in their tax returns. While the Federal Tax Administration (FTA) in Switzerland did not disclose specific details about all 104 countries involved, India has consistently received this information for five years.

The information received through the Automatic Exchange of Information (AEOI) has been valuable for India in prosecuting cases related to unaccounted wealth. The details mainly pertain to businessmen, including non-resident Indians settled in various countries. Switzerland agreed to AEOI with India after assessing India’s legal framework for data protection and confidentiality.

Swiss authorities have previously shared information on hundreds of Indian citizens and entities based on administrative assistance requests. The AEOI applies to active or closed accounts from 2018 onwards. It also includes information on real estate assets owned by foreigners in Switzerland, helping India investigate tax liabilities associated with these assets.

Overall, the AEOI framework enhances transparency in financial transactions and contributes to India’s efforts to combat black money and tax evasion. It also helps Switzerland redefine itself as a global financial center while dispelling misconceptions about its banking system as a safe haven for illicit funds. However, some types of information, such as contributions to non-profit organizations and investments in digital currencies, remain outside the scope of AEOI.